To keep pace with inflation and cover growing operational expenses, Canyons School District is proposing an increase in the Certified Rate for the 2025-2026 school year.

The public is invited to learn more and provide input at a Truth-in-Taxation hearing on Tuesday, Aug. 5 at 7 p.m. in the Canyons Board of Education chambers located at 9361 S. 300 East in Sandy.

The meeting will be broadcast live on CSDtv. Patrons may participate in the public-input portion of the hearing by signing up to speak in-person or by sending input via email to communications@canyonsdistrict.org.

To ensure all voices are heard, written comments received via email will be read aloud by staff members and kept as part of the official record. All written comments must be accompanied by the sender’s name and address, and there is a 500-word limit.

If approved, the proposed rate increase would generate about $6.6 million in revenue. Of that, $4.1 million would cover operational needs, such as increased compensation for teachers and staff. Another $2.5 million would cover capital expenses, including lease-revenue bond payments to help pay for the new high-tech learning center to be located at the former regional headquarters of tech giant eBay.

How would the money be used?

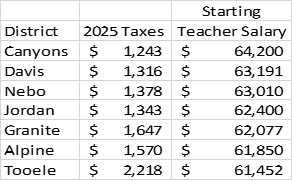

Property taxes levied for District operations are used to help pay for salaries and benefits of District employees, including teachers, principals, paraprofessionals, custodians, and others who provide instructional and other support services in schools. The proposed tax rate would yield $4.1 million in General Fund revenue to offset inflationary increases and reductions in state funding, which are putting a squeeze on fixed education budgets. With the aim of preserving funding for school and classroom needs — most notably by investing in teacher compensation to ensure we have top talent for our classrooms — Canyons has managed inflationary pressures through the redeployment of District Office staff and other cost-cutting measures. Investing wisely has meant Canyons collects less Certified Rate revenue per the average home value than neighboring Districts while still offering the highest starting salary for teachers (see figure below). Since 2019-2020, the starting teacher pay in Canyons has grown from $50,000 to $64,200, an increase of $14,200 or 28.4 percent.

District Comparison

Tax on a $740,000 Home and Starting Teacher Salary

*The Certified Tax Rate or the top line on the tax statements, which reads “Canyons School District”

Costs, from expenditures for school meals and supplies to utilities, meanwhile, continue to rise even as the buying power of $100 declines (see figure below). For more details, see the tentative budget for 2025-2026. Other expenses include:

- Increased costs for utilities, supplies, software, and textbooks

- $2.1 million increase in health insurance premiums (supplemented by $850,000 increase in employee deductibles) to cover inflated medical costs.

- New assistant principal hires to help support elementary schools with behavioral challenges and academic performance (supplemented by the redeployment of existing District Office staff).

- $2.5 million for Capital expenditures, primarily the lease-revenue bond payment for a new high tech learning center located at eBay’s former regional headquarters (supplemented with existing capital funds and the sale of District property).

Don’t property taxes already keep pace with inflation?

No. In Utah, property tax rates are automatically adjusted to compensate for swings in property values. This adjusted tax rate is called the Certified Tax Rate. As property values rise, the certified rate falls so as to keep neutral the amount of revenue generated from year to year. This system, as designed by the state Legislature in 1985, allows local governments and school districts to draw the same amount of revenue as budgeted the previous year. However, the certified tax rate does not capture inflation. For this reason, taxpayer advocacy groups have endorsed the practice of taxing entities issuing modest tax increases to recoup recurring inflationary losses. This is done through Utah’s Truth-in-Taxation process.

How will this impact my taxes?

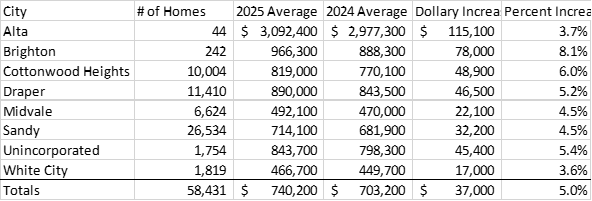

The exact amount for each home is shown on the property tax notices mailed by the Salt Lake County Auditor by July 22, 2025. The annual tax increase for the average home in Canyons District (valued at $740,000) would be $69.60 (under $6.00 per month). That’s a 5.7 percent increase.

Why did my taxes go up more or less than the state average increase?

Generally, when property values grow, property tax rates decline to maintain revenue neutrality. Even with this built-in ceiling effect, some property owners might have a higher property tax bill while others see a decrease. This is because the tax rate is based on average home valuations. If your home was recently assessed or your valuation rose at an above-average rate, you would see an increased payment. If your home valuation was below-average, you may pay less. Home values have increased at a much higher rate than commercial buildings, which can push more of the tax impact to homeowners. Homeowners, however, receive a 45 percent exemption on their home value while commercial properties do not.

What is the average value of a home in Canyons District?

From 2024 to 2025, the average home value in Canyons District increased 5 percent. The highest home values are in Draper and the ski towns of Alta and Brighton. The highest percentage increase occurred in Brighton and City of Cottonwood Heights

What relief is available for homeowners on fixed incomes?

We appreciate some of our patrons who are living on fixed incomes struggle to afford even modest property tax increases. In their foresight, the Utah Legislature has created six different relief programs for qualifying low-income, elderly, and disabled homeowners. Information for tax relief and referral programs can be found on Salt Lake County’s website. Applications must be submitted by Sept. 2, 2025.

Some homeowners may feel the value of their property is overstated by the Salt Lake County Assessor’s Office. If you feel this is the case, you may consider appealing to the Board of Equalization. Information can be found on the Salt Lake County Auditor’s website. The deadline for appealing is Sept 15, 2025.

What’s the line on my property tax notice titled, “Canyons School Debt Service?”

Debt service is revenue used to repay the two general obligation bonds voters approved in 2010 and 2017 to refurbish and perform seismic upgrades on outdated schools. The amount you see listed decreases as Canyons pays down the bonds. In other words, this is not a new assessment. It’s merely showing progress toward repayment.