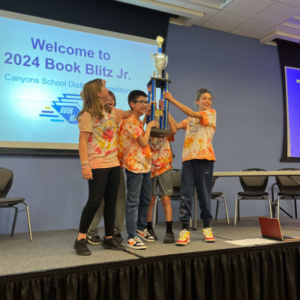

The 2015 Legislature raised property taxes to help meet the capital needs of struggling school districts. These higher rates will generate $75 million statewide for districts meeting the criteria established in the legislation, SB97. Residents and business owners in Canyons will be required to pay the tax, but the District will not qualify to receive funds generated by it. The tax increase, which is expected to be an extra $5 on a $250,000 home, was imposed by state lawmakers. The Canyons Board of Education has no control over the tax nor the garnered revenues.