Investing in your Future

Financial fitness now leads to a healthy retirement later.

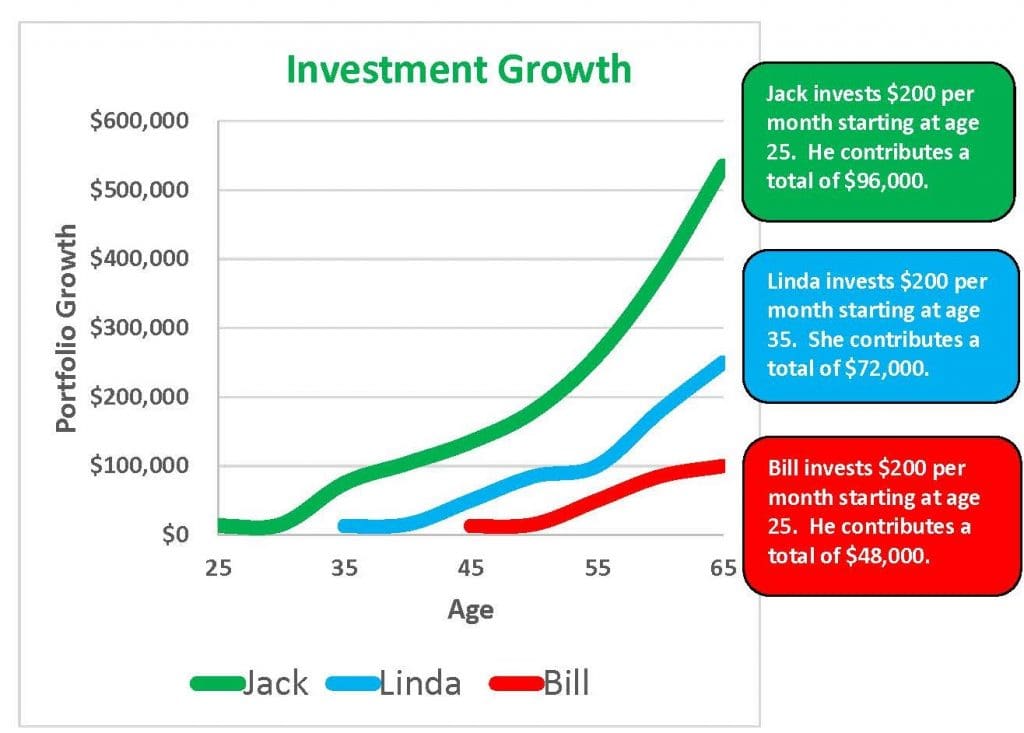

What difference does it make if you wait until you make more money to invest?

Waiting to invest carries a high cost. The younger you are when you begin to invest, the more time your money has to grow, and if there are drops in the market, there is time to recover.

In the following example, all 3 employees invested $200 per month. Jack (green line) began investing at age 25. By the time he is 65 his portfolio is worth over $520,000. Linda (blue line) didn’t start investing until age 35, by age 65 her portfolio is only worth about $245,000. By waiting 10 years to start, she ends up with less than half of what Jack accumulates. Bill (red line) waited until he was making more money, he starts investing at age 45, after 20 years his portfolio barely gets up to $100,000.

Don’t wait to invest in your future!

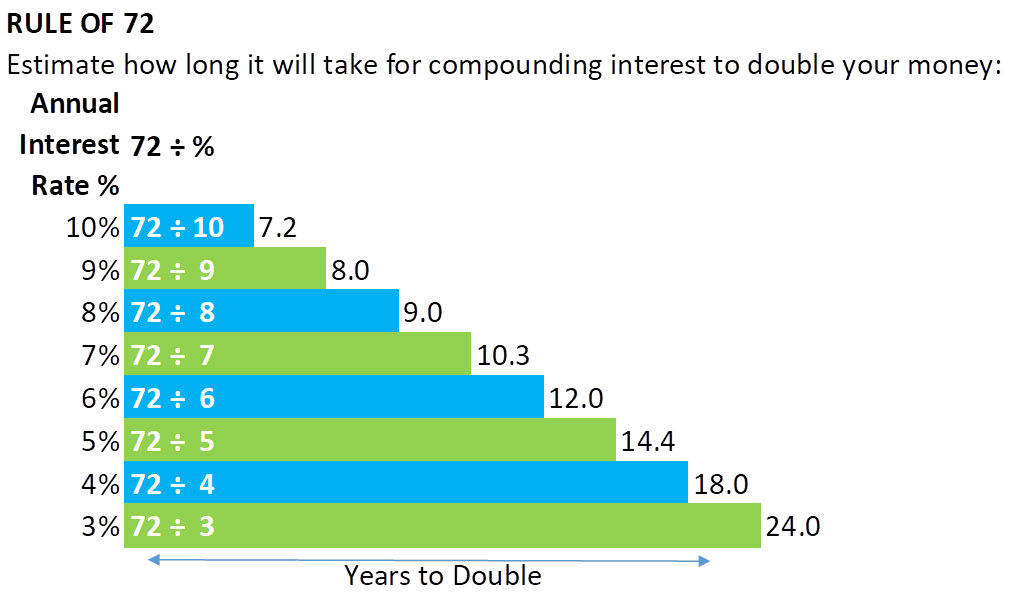

The rule of 72 is how long it will take for your money to double. The formula is: 72 divided by the annual interest rate equals the number of years to double. If the interest rate is 6% then the formula would be 72 ÷ 6 = 12. It would take 12 years for your money to double.

Investment Principles

Risk tolerance is the degree of variability in investment returns that an investor is willing to withstand. You should have a realistic understanding of your ability and willingness to stomach large swings in the value of your investments; if you take on too much risk, you might panic and sell at the wrong time.

Dollar-cost averaging (DCA) is an investment technique which involves buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price. As a result of the approach, the investor ends up purchasing more shares when prices are low and fewer shares when prices are high.

Diversification is a risk management technique that mixes a wide variety of investments within a portfolio. The rationale behind this technique contends that a portfolio constructed of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.

Rebalancing is the process of realigning the weightings of a portfolio of assets. It involves periodically buying or selling assets in a portfolio to maintain an original desired level of asset allocation.

URS Manages the retirement for CSD. For information on your retirement log in to URS.org. They publish a brochure about your Investment Options that will help you determine how you want to invest.